Accounts receivable and accounts payable are similar to one another. Accounts payable refer to the money your business needs to pay others, like suppliers or service providers. On the other hand, accounts receivable is the money your business expects to receive from customers for goods or services sold. So, let’s understand the difference between accounts payable and accounts receivable with examples-

Example of Accounts Payable:

Let’s say a tech company produces laptops and smartphones. To create these products, it buys parts and materials from factories in Japan and China. The payments made to these factories are recorded as accounts payable because the company needs to pay this money to its suppliers.

Example of Accounts Receivable:

Suppose a merchant sold 1,000 T-shirts to Company A at £10 each, totaling £10,000. Company A pays £5,000 in front but agrees to pay the remaining £5,000 in three months. Until the remaining amount is fully paid, this £5,000 is listed as accounts receivable in the merchant’s books.

To Sum Up:

- Accounts Payable: Money your business needs to pay others.

- Accounts Receivable: Money your business expects to collect from customers.

Understanding the difference between AP and AR is crucial for managing cash flow and keeping your business finances organised. Properly tracking what you need to pay and what you’re owed can help you plan payments better, reduce debts, and boost profitability.

At SAS KPO Services, we provide expert support to manage your accounts payable and receivable, ensuring that everything is tracked accurately and efficiently. Our team helps you stay on top of cash flow, reduce debt, and keep your finances running smoothly, so you can focus on growing your business.

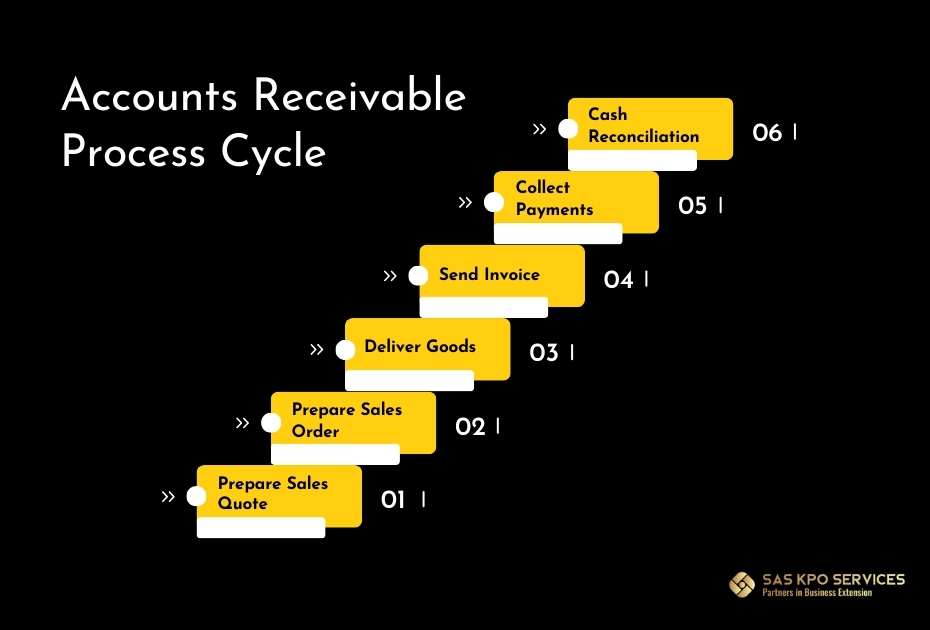

Accounts Receivable Process Cycle

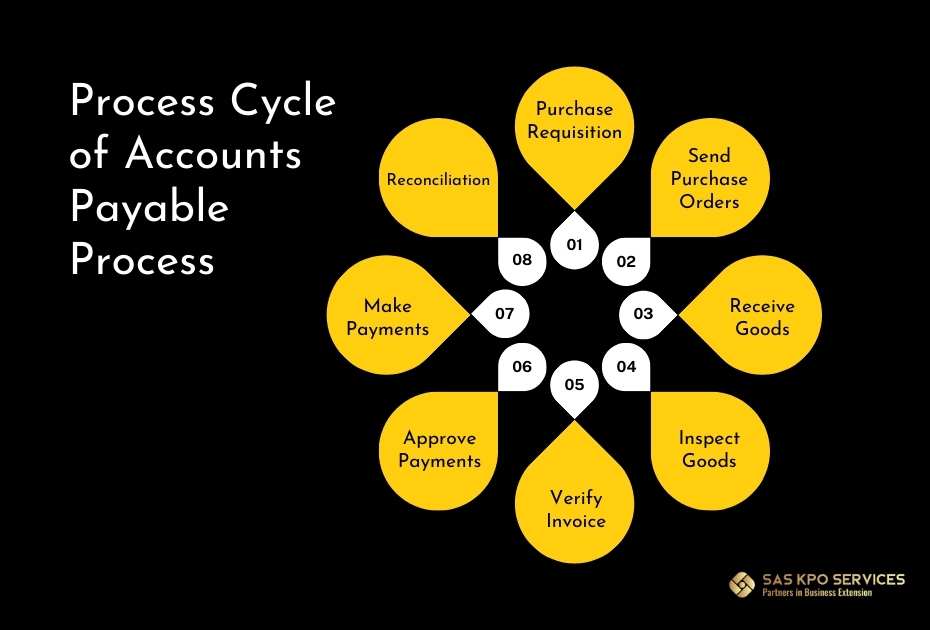

Process Cycle of Accounts Payable Process

When To Use Accounts Receivable

Businesses rely on accounts receivable to track and manage customer payments that are still pending. It plays a key role in maintaining healthy cash flow and financial stability.

Managing Cash Flow:

Accounts receivable helps businesses keep track of money needed to be paid by customers. By monitoring these payments, businesses can ensure they receive their dues on time, which is essential for effectively managing cash flow. This process helps avoid cash shortages and supports smooth business operations.

Credit Management:

Tracking accounts receivable allows businesses to manage customer credit effectively. It helps ensure that payments are collected promptly, reducing the risk of bad debts, and improving the company’s financial health.

Financial Reporting:

Accounts receivable represent the money a company expects to receive from customers. It’s recorded as a current asset on the balance sheet, indicating the company’s liquidity. This information helps stakeholders understand the financial position and overall health of the business.

In summary, businesses use accounts receivable to keep track of outstanding payments, manage cash flow, and maintain accurate financial records. It plays a vital role in maintaining financial stability and promoting the growth of the company.

Cost of Maintaining Receivables

Receivables management is the process of making informed decisions regarding investments in trade debtors, or the money owed to a business by its customers. This process is crucial for businesses as it helps them effectively manage their outstanding accounts and make strategic decisions that benefit their financial health.

Maintaining receivables involves costs that businesses must consider, such as administrative expenses related to tracking and collecting payments, the risk of bad debts from customers who may not pay, and the opportunity cost of not having that money available for other business operations. By effectively managing these receivables, businesses can ensure they have a steady cash flow, which is essential for covering day-to-day expenses and investing in growth opportunities.

Good receivables management enables businesses to assess the creditworthiness of customers, set appropriate payment terms, and implement effective collection strategies. By doing so, companies can minimise the costs associated with maintaining receivables, improve their cash flow, and enhance their profitability.

Lastly, understanding the cost of maintaining receivables is vital for businesses to make sound financial decisions and ensure sustainable growth.

Understanding the Cost of Maintaining Accounts Payable

The cost of maintaining accounts payable refers to the expenses a company collects while managing its unpaid bills or debts to suppliers and vendors. Accounts payable are all about tracking and managing the money your business needs to pay for purchases, supplies, and services.

These costs include various activities like processing and recording invoices, verifying bills, managing payment schedules, and keeping relationships smooth with vendors by ensuring payments are made on time. It can also involve costs for maintaining systems and staff who handle these tasks, such as accounting clerks or software subscriptions.

Effectively managing accounts payable helps avoid late fees and keeps your suppliers happy, which is crucial for maintaining a good reputation and strong business relationships. Understanding the expenses tied to this process can lead to better financial planning and efficiency for your business.

Primary Objectives for Receivable Management

Receivable management is essential for businesses to ensure financial stability and growth. The main goals of receivable management are the following:

Improving Cash Flow:

One of the main goals is to make sure that payments from customers are collected on time. When businesses receive payments promptly, it helps maintain a steady flow of money, which is crucial for covering daily expenses and funding future projects.

Optimising Collections:

Another important objective is to develop effective strategies for collecting payments. This means creating efficient processes for following up on overdue accounts and ensuring that the collection efforts are streamlined. By optimising collections, businesses can reduce the time and resources spent on chasing payments.

Maintaining Customer Relationships:

While it’s important to collect payments on time, businesses also need to focus on building and maintaining positive relationships with their customers. Striking the right balance between requesting timely payments and providing excellent customer service is key. Customer loyalty and repeat business are two benefits of having positive connections.

The primary objectives of receivable management revolve around improving cash flow, optimising collection processes, and maintaining strong customer relationships. By focusing on these objectives, businesses can enhance their financial health and ensure long-term success.

Primary Objectives for Payable Management

The main goal of managing accounts payable is to effectively handle a company’s outgoing payments and financial obligations. Here’s a breakdown of the primary responsibilities involved:

Invoice Processing:

This involves checking, verifying, and processing invoices received from suppliers and vendors. It’s crucial to ensure the invoices are accurate and follow the company’s policies.

Payment Management:

The focus here is on scheduling and making timely payments to suppliers. This helps maintain good relationships with vendors and avoids late fees or penalties.

Record Keeping:

Keeping accurate records of all transactions is essential. This includes maintaining documentation like invoices, payment receipts, and any communications with suppliers.

Collaboration:

Accounts payable management also involves working closely with other departments, such as Ownership and Finance. This collaboration helps to smooth out payment processes and resolve any payment issues quickly.

By fulfilling these objectives, accounts payable management ensures that a company’s payment obligations are met efficiently, helping maintain positive seller relationships and supporting smooth business operations.

Dimensions of Receivables Management

Opportunity cost refers to the value of the next best option you give up when you make a choice. In simple terms, it’s what you miss by not picking another alternative.

When it comes to managing receivables, there are several costs to consider:

Accounting Charges:

These are the expenses related to maintaining accounts and keeping track of transactions. It involves all costs incurred to record and monitor payments and debts.

Collection Costs:

This includes the costs involved in operating and managing the collection department. It covers efforts to ensure customers pay on time and that overdue payments are collected efficiently.

Administrative Costs:

These are the salaries and expenses for clerks who maintain records of debtors. It also covers costs for checking the creditworthiness of customers to minimise risk.

Understanding these costs is essential for effectively managing receivables, as it impacts both cash flow and overall profitability.

Dimensions of Payable Management

Managing accounts payable involves several key areas that impact a company’s efficiency and expenses. Here’s a breakdown of these dimensions:

Labour Costs:

The biggest expense in accounts payable is usually the cost of staff salaries and benefits. This includes employees responsible for handling invoices, entering data, and approving payments. Managing this labor effectively is crucial to keeping costs down.

Technology Investment:

Investing in the right software and technology can make a big difference. Automation tools can match invoices, schedule payments, and keep records, saving time and money overall by reducing manual errors and improving efficiency.

Overhead Costs:

Overhead expenses refer to fixed operating costs that aren’t directly tied to a specific product or service. These can include expenses related to office space, utilities, and equipment used for managing accounts payable.

Error Management:

Errors in accounts payable can lead to issues like duplicate payments, overpayments, or underpayments. Fixing these mistakes requires additional resources and can lead to increased costs. Reducing errors through checks and automated systems is essential for smooth operations.

By focusing on these key dimensions, businesses can better manage their accounts payable process, minimise costs, and improve overall efficiency.

Common Challenges Faced in the Accounts Payable Process

Managing accounts payable (AP) can be a complex task with several challenges. Here are some of the most common issues faced by AP departments:

Too Much Paperwork:

Many companies still receive a large number of invoices as physical documents. This results in a lot of paperwork that needs to be sorted, organised, and managed. The time spent on these tasks can take away from more important activities, reducing overall productivity.

Lengthy Approval Process:

Invoices often require approval from multiple levels and different departments, especially when the payment amount is high. This can significantly delay the approval process, slowing down payments and creating inefficiencies.

Lack of Visibility:

Paper-based processes make it difficult for AP teams to track invoices and monitor cash flow effectively. Without a clear view of the financial picture, it becomes challenging to manage finances and avoid issues.

High Administrative Costs:

Handling physical paperwork, maintaining storage, and employing staff for manual work can drive up operational costs. Administrative expenses can become a significant burden for businesses relying heavily on paper-based AP processes.

Delayed Payments:

Manual workflows often lead to delays in processing payments, which can cause missed deadlines and late fees. Delayed payments can also harm relationships with suppliers.

Duplicate Invoices:

Tracking duplicate invoices can be tricky, whether due to supplier mistakes or potential fraud. Duplicate payments are not only costly but also consume time and resources to resolve.

Limited Visibility:

With manual, paper-based processes, it’s hard to get a clear view of the overall workflow and track the status of each invoice in real-time. Poor financial management may result from this lack of sight.

Time-Consuming Processes:

Manual processing often involves multiple levels of direct approval. Each invoice needs to pass through several hands, increasing the cycle time and slowing down the payment process.

These common challenges highlight the importance of adopting streamlined processes and leveraging automation to improve efficiency and accuracy in managing accounts payable.

Objectives of Accounts Receivable and Accounts Payable Management

Effective management of accounts receivable and accounts payable are crucial for maintaining a company’s financial health. Here are the key objectives for both:

Timely Collection & Seller Payments:

Efficiently managing receivables means collecting payments from customers promptly, ensuring a healthy cash flow. On the other hand, paying suppliers on time helps maintain strong relationships and build trust with sellers.

Optimising Cash Flow:

Managing both receivables and payables effectively allows a business to keep cash available for operational needs while maintaining liquidity. This balance is key to running daily operations smoothly.

Minimising Bad Debt & Reducing Costs:

Reducing the risk of non-payment by monitoring customer accounts closely helps minimise financial losses. Similarly, taking advantage of early payment discounts and avoiding late fees with sellers helps reduce overall costs.

Enhancing Relationships & Maintaining Compliance:

For receivables, maintaining positive relationships with customers through flexible payment terms and effective communication is basic. For payables, it’s essential to comply with contracts, legal obligations, tax requirements, and regulations to avoid legal issues.

Streamlining Processes for Efficiency:

Automating and optimising processes for managing invoices, collections, and payments reduces administrative burdens in both accounts receivable and accounts payable. This boosts efficiency and saves time.

Improving Financial Control & Credit Risk Monitoring:

Accurate tracking and management of liabilities help prevent errors, improve financial reporting, and reduce fraud risks. At the same time, monitoring the creditworthiness of customers prevents potential defaults and improves cash flow.

By achieving these objectives, a company can ensure steady cash flow, minimise risks, maintain good relationships with customers and sellers, and increase financial stability.

Benefits of Outsourced Accounts Receivable and Payable Services

Outsourcing both accounts receivable (AR) and accounts payable (AP) processes can offer a wide range of benefits for businesses. Here are the key advantages:

Cost Savings:

Outsourcing AR and AP processes can significantly reduce costs by eliminating the need to hire, train, and maintain an in-house team. It also removes the overhead expenses of employee benefits, office space, and equipment. This allows businesses to focus on their core activities while saving on operational costs.

Improved Efficiency and Speed:

Outsourcing helps speed up the invoice and payment processes. With outsourced AR services, businesses can efficiently manage their receivables, resulting in faster payments from customers. Similarly, AP services provide technology-provided solutions that help with quick and accurate payment processing to sellers.

On-Time Payments & Customer Satisfaction:

For AR, effective management leads to improved customer relationships by fostering better communication and reducing payment debate. On the AP side, an outsourced team can ensure timely seller payments through various payment methods like Bank ACH or Wire transfers, which helps maintain good relationships with suppliers.

Enhanced Business Analysis & Accuracy:

Outsourcing AR services not only helps manage payments but also aids in fundamental business analysis, offering insights into cash flow patterns and financial health. Meanwhile, outsourced AP teams perform person-to-person quality checks to ensure accurate processing of seller invoices, reducing errors and boosting overall efficiency.

Access to Advanced Technology & Resources:

Outsourced AP solutions often come with the latest technology like AP automation platforms, which streamline workflows and improve data accuracy. These solutions are designed to be scalable, adapting easily to the changing needs of the business.

Quick Set-Up & Seamless Integration:

An outsourced AP team can be set up quickly, trained on the company’s systems, and integrated into existing workflows to ensure smooth operations. This allows businesses to adapt without losing valuable time.

By outsourcing these critical financial processes, businesses can gain significant cost savings, improve efficiency, and enhance relationships with both customers and suppliers.

Best Accounting Software for Tracking Accounts Payable and Accounts Receivable

Choosing the right accounting software can make managing accounts payable and accounts receivable much easier. The top software solutions allow you to schedule automatic payment reminders and create aging reports, helping you keep track of both incoming and outgoing payments.

QuickBooks:

QuickBooks, developed by Intuit, is a popular accounting software that helps businesses manage finances effectively. It offers features for tracking income and expenses, handling payroll, creating financial reports, sending invoices, and managing tax-related tasks.

FreshBooks:

FreshBooks is a cloud-based accounting software designed for freelancers, independent contractors, and small business owners. It simplifies tasks such as tracking expenses, managing invoices, tracking time, and generating financial reports.

Xero:

The cloud-based accounting software Xero was developed with small and medium-sized businesses in mind. It supports various financial tasks, including managing payroll, tracking inventory, reconciling bank transactions, invoicing customers, and preparing financial reports.

Plooto:

Plooto is an ideal solution for businesses that need to manage payments to contractors, suppliers, and vendors, as well as receive payments from customers. Cash flow management is enhanced, and the payment procedure is streamlined.

These software options provide valuable tools to help businesses manage their Accounts payable and accounts receivable efficiently, allowing for better financial control and streamlined operations.

Final Thoughts

Understanding the difference between accounts payable and accounts receivable is essential for maintaining a healthy financial flow in your business. The funds your company needs to pay suppliers are known as accounts payable, and the money you anticipate receiving from clients is known as accounts receivable. By effectively managing both, you can enhance cash flow, minimise costs, and foster strong relationships with your sellers and clients.

If you’re looking to streamline your financial processes and need expert assistance, our team at SAS KPO Services is here to help! We specialise in comprehensive accounts outsourcing services that can free up your time and improve your financial health.

Reach out to us today to learn how we can support your business in managing AP and AR efficiently. Contact us now for personalised services tailored to your needs!